Renters Insurance in and around Summit

Summit renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Springfield

- Union County

- Summit

- Chatham

- Essex County

- Somerset County

- Hudson County

Home Is Where Your Heart Is

Being a renter doesn't mean you are 100% carefree. You want to make sure what you own is protected in the event of some unexpected mishap or damage. And you also need liability protection for friends or visitors who might get hurt on your property. State Farm Agent Glisel Jimenez is ready to help you navigate life’s troubles with dependable coverage for your renters insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Glisel Jimenez can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Summit renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

State Farm Has Options For Your Renters Insurance Needs

The unexpected happens. Unfortunately, the valuables in your rented property, such as a tablet, a video game system and a couch, aren't immune to accident or break-in. Your good neighbor, agent Glisel Jimenez, can help you evaluate your risks and find the right insurance options to help keep your things protected.

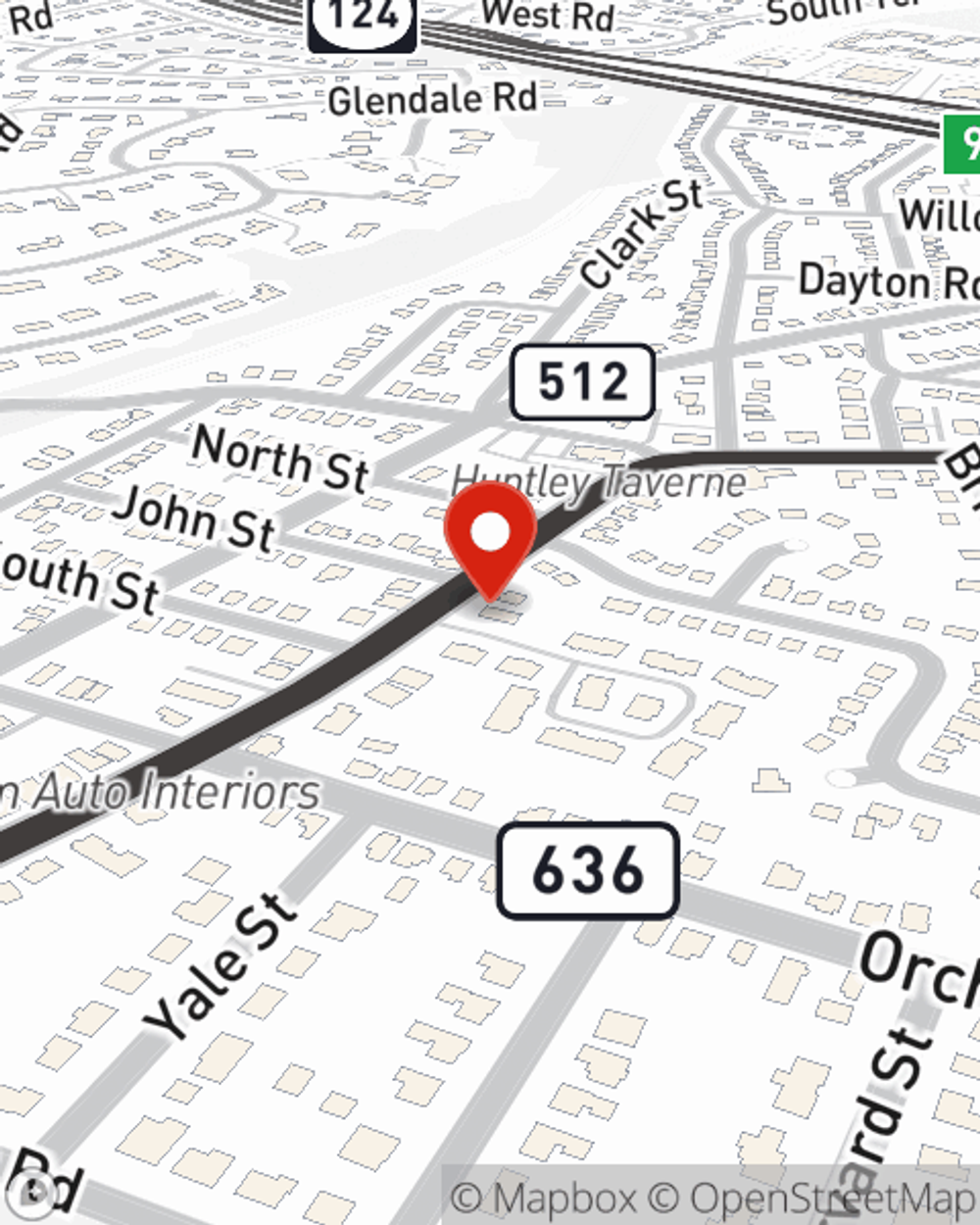

Renters of Summit, State Farm is here for all your insurance needs. Get in touch with agent Glisel Jimenez's office to get started on choosing the right policy for your rented townhome.

Have More Questions About Renters Insurance?

Call Glisel at (908) 277-4099 or visit our FAQ page.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Glisel Jimenez

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.