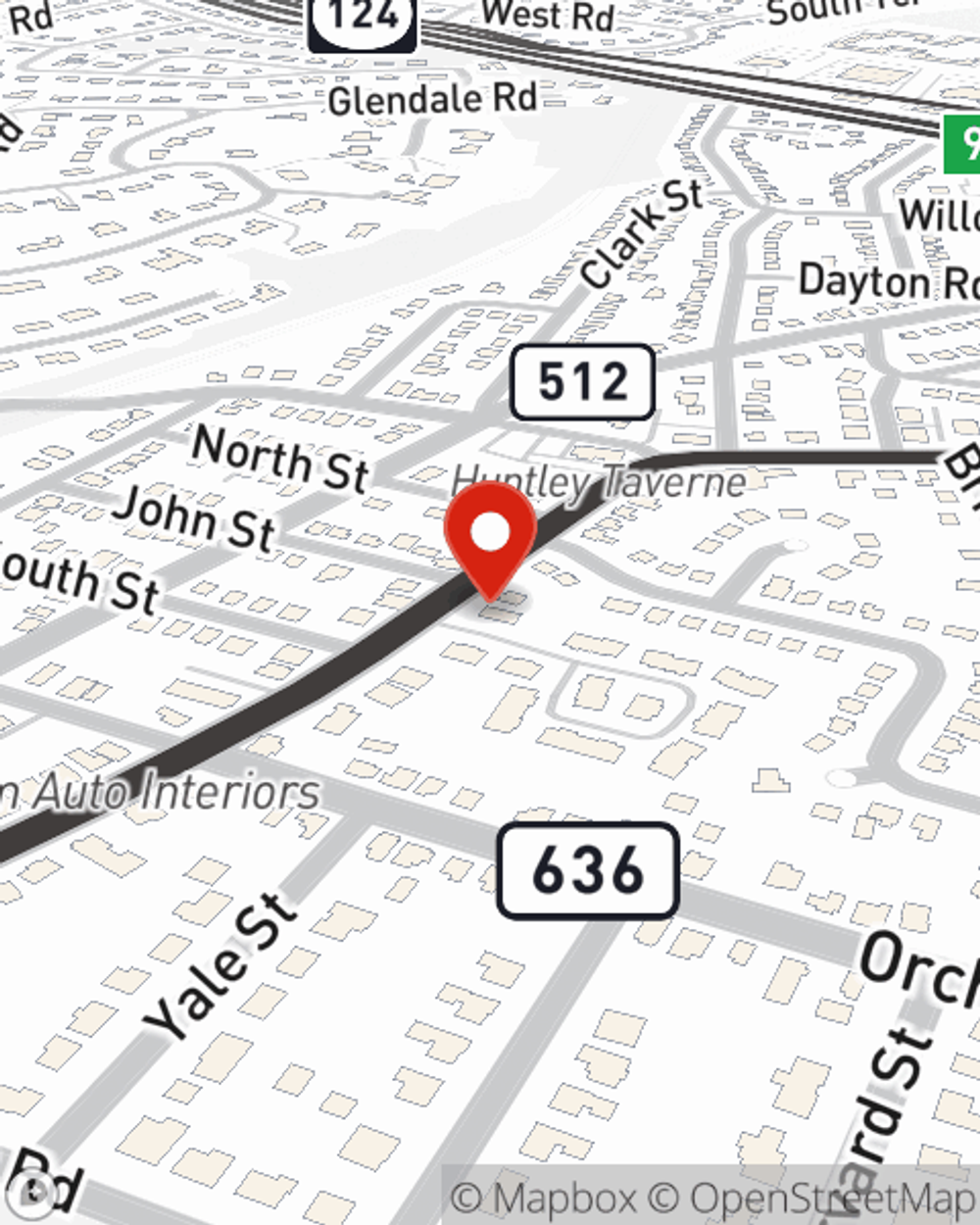

Business Insurance in and around Summit

Calling all small business owners of Summit!

This small business insurance is not risky

- Springfield

- Union County

- Summit

- Chatham

- Essex County

- Somerset County

- Hudson County

Help Prepare Your Business For The Unexpected.

Whether you own a an art gallery, an antique store, or a tailoring service, State Farm has small business insurance that can help. That way, amid all the different moving pieces and decisions, you can focus on your next steps.

Calling all small business owners of Summit!

This small business insurance is not risky

Customizable Coverage For Your Business

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for artisan and service contractors, surety and fidelity bonds or commercial liability umbrella policies.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Glisel Jimenez's office today to review your options and get started!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Glisel Jimenez

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.